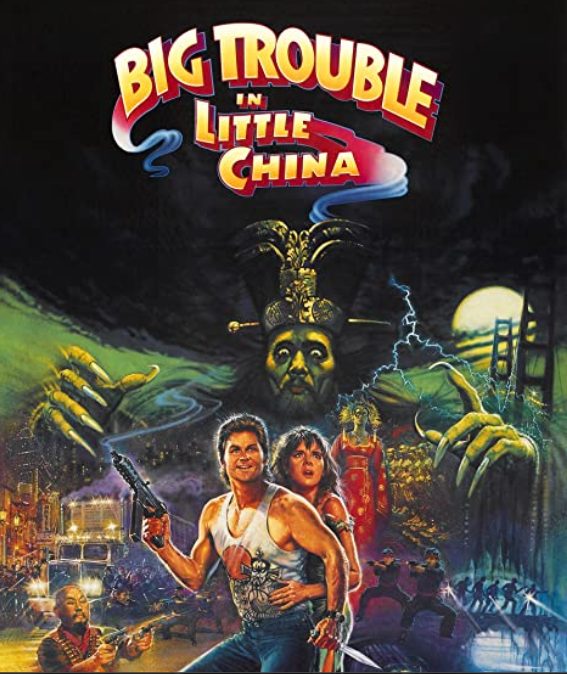

For those old enough to remember it, there was a now cult movie from 1986 called “Big Trouble in Little China”. In an East versus West storyline, the movie was a commercial failure, and depicted an American truck driver who became involved in a battle between good and evil whilst making a delivery to Chinatown. There is now a new real story being written before our eyes that should bear the sequel title. In importance it will be on a scale similar to the Lehman collapse that caused the Global Financial Crisis. How the story ends will depend on how the lead actor plays the cards.

I never understood the importance of History in school, but as I’ve become older (and wiser?) it’s been astounding to see how often not learning from historical mistakes makes us repeat them. China’s property industry, triggered by Evergrande, is about to repeat the script of the globally biggest corporate collapse ever. As a recap, Lehman brothers (and other lenders) were issuing so called sub-prime loans to NINJAs (people with No Income, No Jobs or Assets) and selling these loan books to other financial institutions that didn’t consider the risk profile. With no chance of ever servicing these loans, the inevitable collapse of the banking system and property market followed. Lehman Bros had $US680 billion in outstanding loans supported by only $US22.5 billion in capital, so just a 3.5% fall in property prices would have wiped out all the banks capital equity. Australia was largely isolated from this fallout because our main trading partner China kept buying ever more mining exports from us, ironically to feed the beast (Chinese property development) that this story is about.

Fast forward to August 2020, and the lead character in the story (President Xi Jinping and his Communist Party) correctly identify that China’s property development market had encountered some trouble. Not only are there very high vacancy rates, properties were selling for extreme prices of 30-45 times median incomes (New York is less than 10 by comparison). The developers had a combined debt of more than $US5 trillion, which to put it into context is more than the entire economic output of the world’s third largest economy (Japan). So the Chinese central bank imposed the “three red lines” which aimed to force the developers to de-gear by reducing their bank loans and bonds.

Evergrande is probably the fifth largest developer in China with bank liabilities of roughly $US369 billion (note their other liabilities below are in addition to this). To put that into context, the US’s largest home builder by revenue (D.R.Horton Inc) has $US21.8 billion in net assets. So with reduced borrowing capacity with banks, what do the developers do? In China, pre-sales account for 90% of all sales, so buyers’ part or fully pay for properties as a deposit on buildings that haven’t even been started yet (interest free money to the developers). Evergrande has 1.4 million dwellings “under construction” and can’t pay suppliers (now offering some of them assets like half built flats or one of the 345,000 unsold car parking spaces instead of payment). Last year, Evergrande couldn’t pay employees, so offered to borrow their pays back on the same promises of a future property as an investment. The company was founded only in 1996 and has had massive growth and is seen by Chinese “investors” (meaning the general population that want better than bank interest) as being too big to fail. What could possibly go wrong with so many unpaid and unaccounted for debt obligations, and all these largely paid for yet unfinished buildings?

Home ownership in China is already over 90%, amongst the highest in the world. 87% of home purchases were by buyers who already had at least one dwelling. China, a “developing” country, already has very similar building square meterage per capita to the much more developed UK. Prices can really only go in one direction, especially when there are already more buildings than a declining and aging population can occupy.

Evergrande is but one of about 40% of Chinese developers in this situation but is one of the first to now be defaulting on interest loan repayments. September property sales are down 36% from a year earlier into a market that last month demolished 15 unit buildings simultaneously that hadn’t been completed since work started in 2011.

Consider the flow on effects when just one company bigger than Enron and just smaller than the size of Lehman Bros defaults, let alone several: The obvious first thought is banks being hit by loan defaults, unpaid suppliers, investors losing their capital, and unpaid and unemployed staff (Evergrande alone employs 200,000 people). 29% of China’s economic activity is real estate and construction. Next follows reduced property values, exasperating the default rates and price falls. Most debts in China are private individuals or held by local Governments. Local Government rely on land sales for most of their revenue, and this income from developers fell by 17.5% in August. China’s economy is in for a major shock, but should recent events head towards their logical conclusion, the largest section of the economy will collapse. Demand for everything construction related will fall, right through to Australia’s current major export: iron ore.

China deserves credit for its ability over decades to contain financial crisis within its borders. Some experts believe that China is having it’s “Lehman’s moment” and will decide that these mega businesses are simply too big to be allowed to fail. But rescuing them is a massive financial undertaking, so a more likely response seems to be to contain the contagion to the property/development segment and those exposed domestically and internationally to it simply being “collateral damage” (didn’t we see an example of such a Chinese “containment” strategy about 2 years ago?). Meanwhile, the central bank would continue to lend and prop up other industries to reduce the impact on consumer spending and avoid more widespread unemployment. All eyes will be on the main actor in this action saga. Let’s hope China can pull a rabbit out of its magic hat, and that the script doesn’t flop financially like the original movie did.

(PS, we have heard of Chinese manufacturers now sending letters to their customers suggesting orders be placed now, because industry has been given notice that power supply will be rationed during the upcoming China Winter Olympics, forcing factory closures. Meanwhile, on the down low, China has resumed accepting Australian coal for power generation. Nice signal just before Glasgow’s climate summit).

Why Counteroffers don’t work

Did you know that 80% of departing employees that accept a counteroffer to stay with their employer still leave within 6 months? By the 12 month mark, the statistics are that 90% have left.

The reason is that whatever carrot the employer dangles probably didn’t address the underlying reason the person looked elsewhere in the first place. Rarely is it just the money or the fact they know their job and the company inside out. Understanding the underlying reason for leaving is paramount. Often this has nothing to do with the company itself. Think for instance personal relationships, family, travel distances, a propensity to spend every cent they earn (or more), midlife crisis, or even yearning for a tree/sea change.

Some reasons of course are within the control of the company. But just like putting off a divorce because the partners commit to change, often they can’t or won’t. The only time counter offers seem to work is when there is a genuine understanding of the REAL reason someone is looking to leave, and that is addressed by real change. If neither the employer nor employee believes that to be the case, it is better to exit stage left at the first interlude than to cling to some hope whilst the dissatisfaction simmers and grows.

As always, onwards and upwards!

Fred Carlsson

General Manager